44+ Forgiveness Tax Penalty Waiver Letter Sample

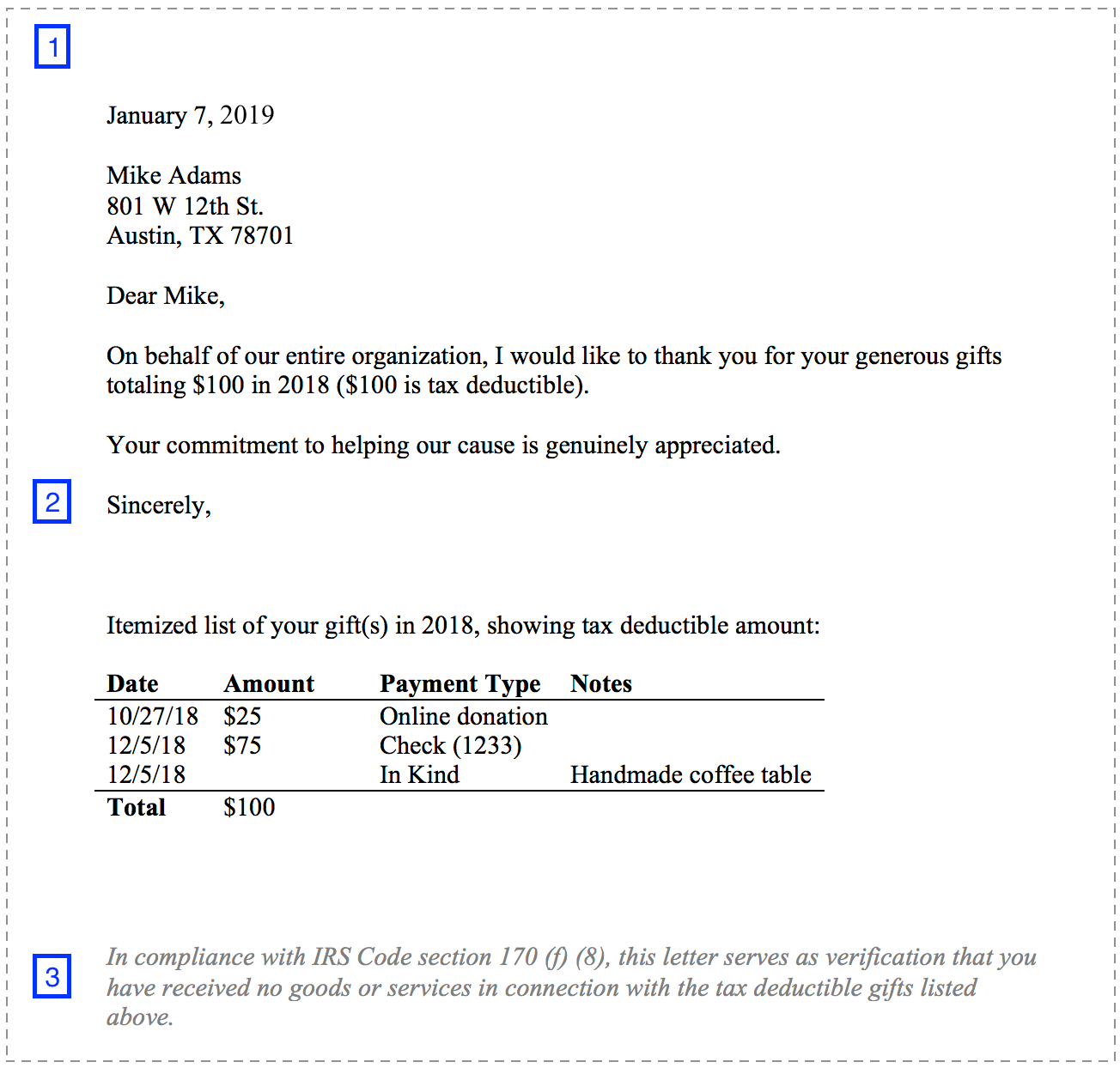

In this article I provided a sample letter for penalty. Sample 1 Debt Forgiveness Letter.

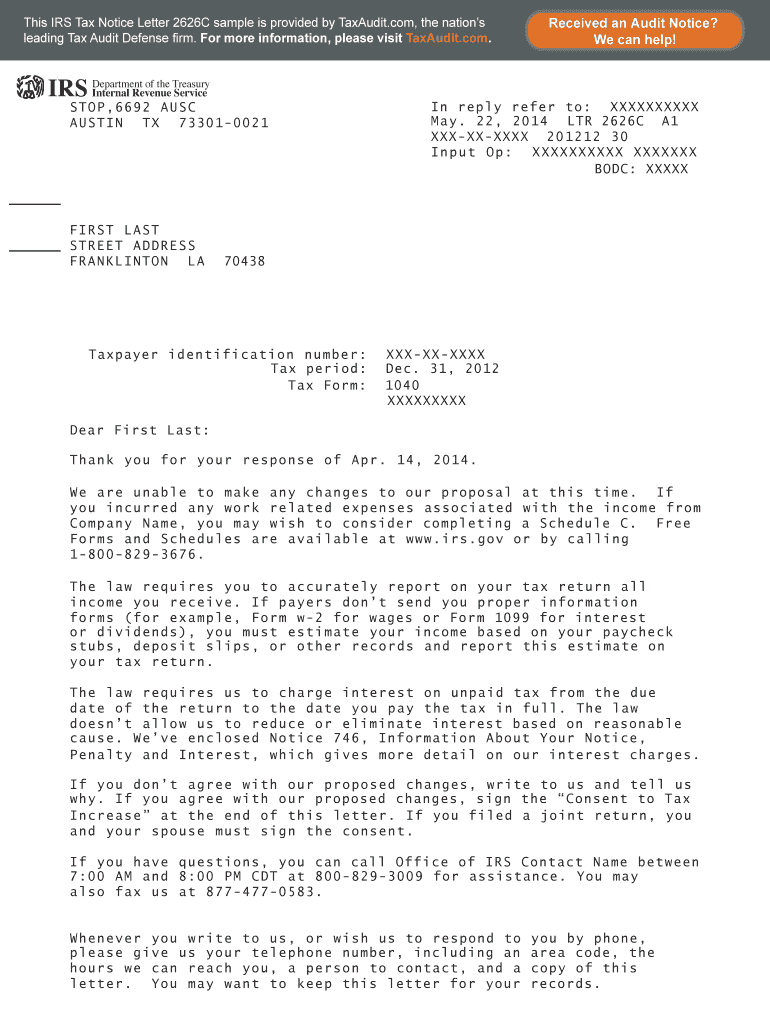

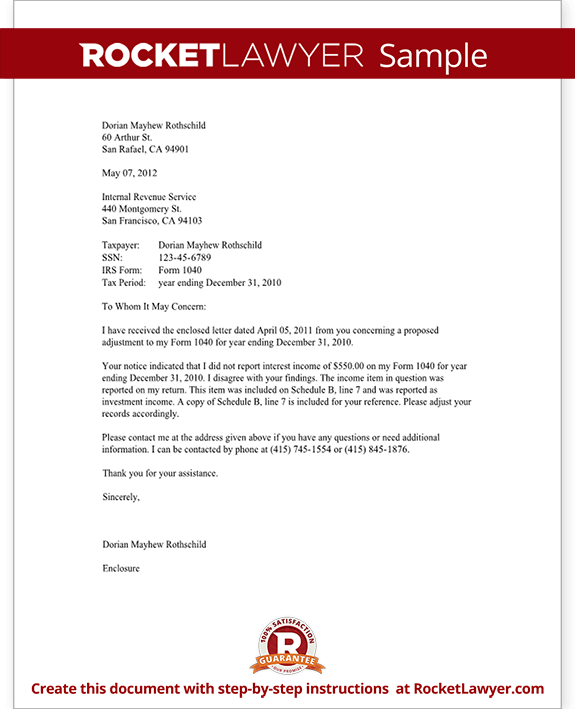

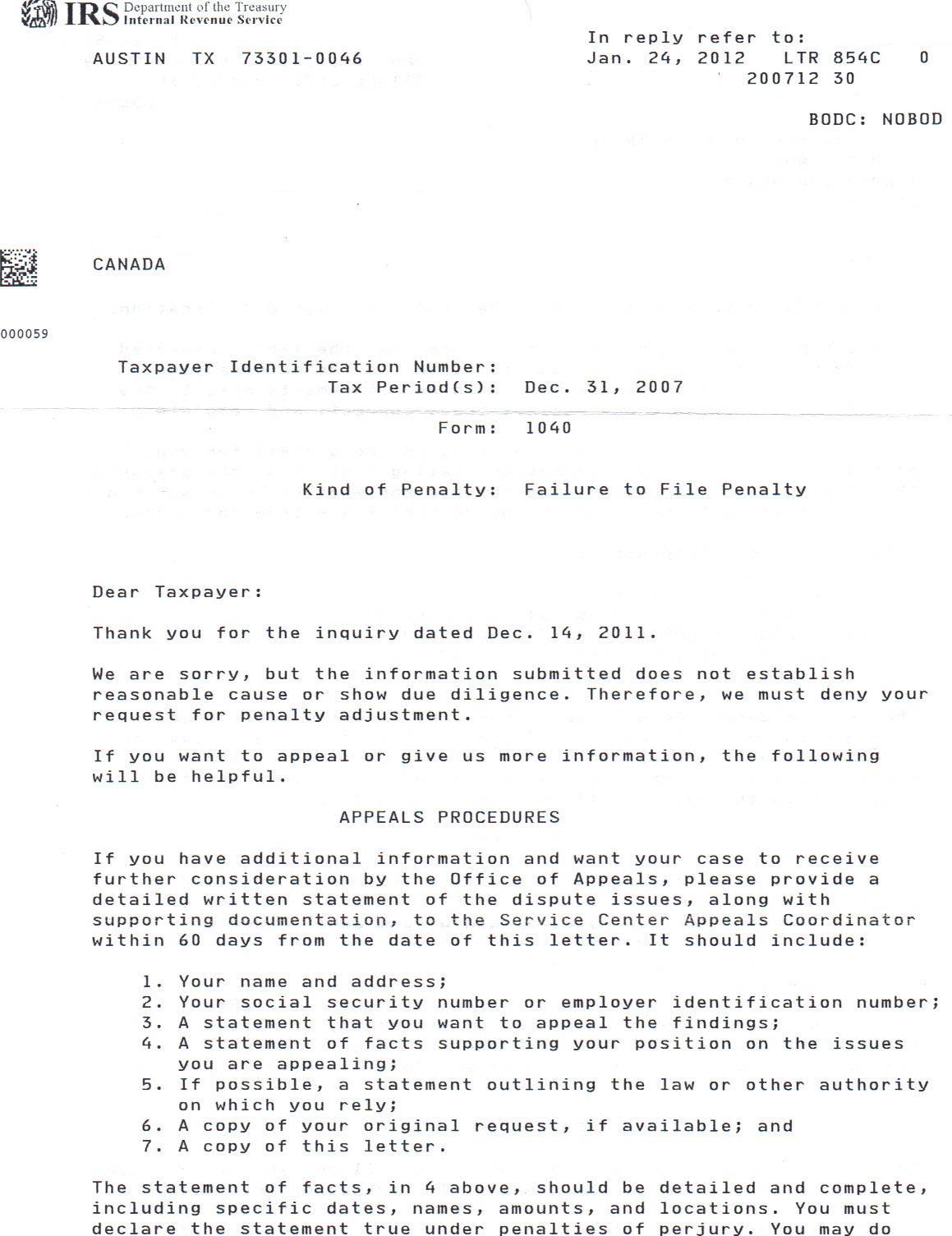

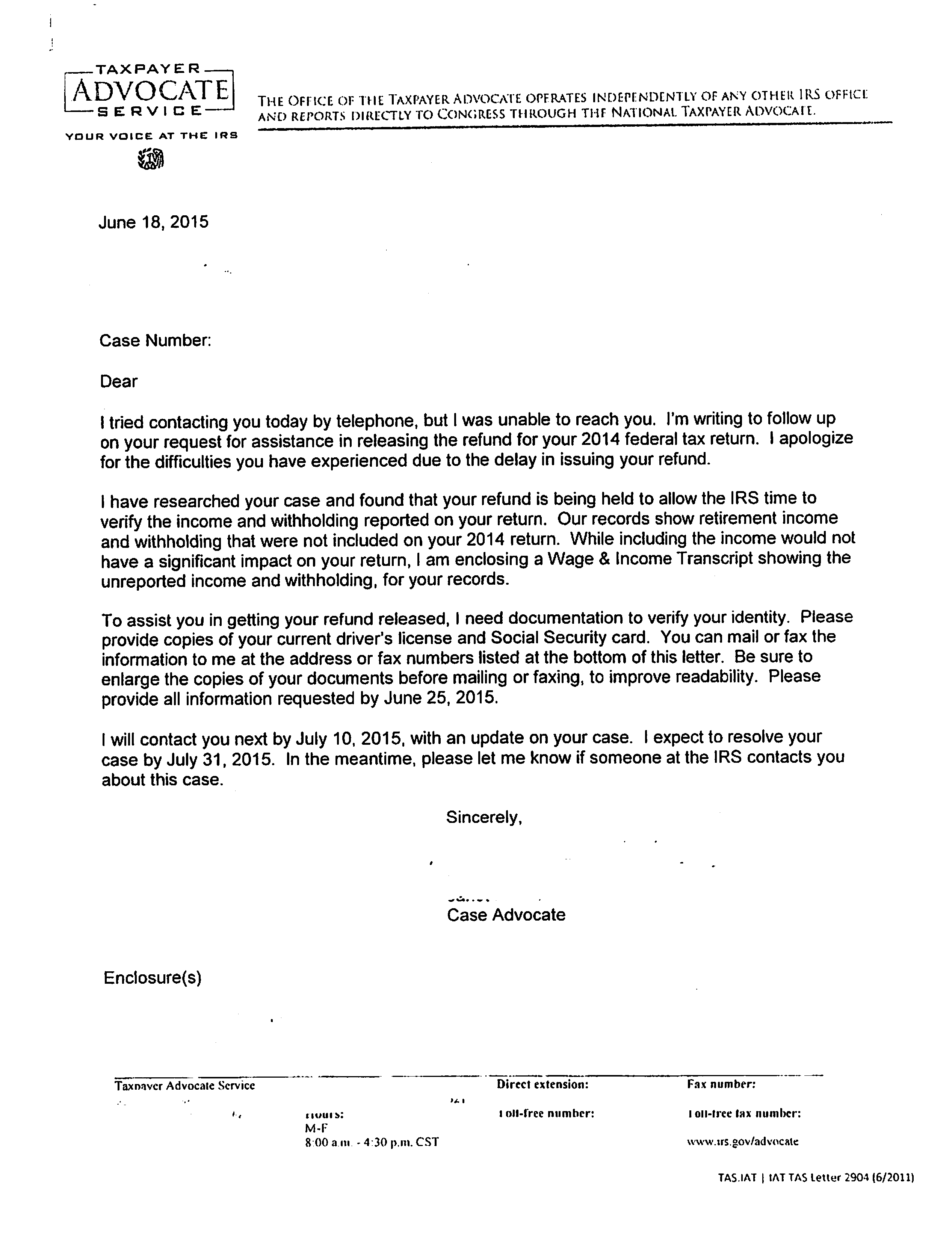

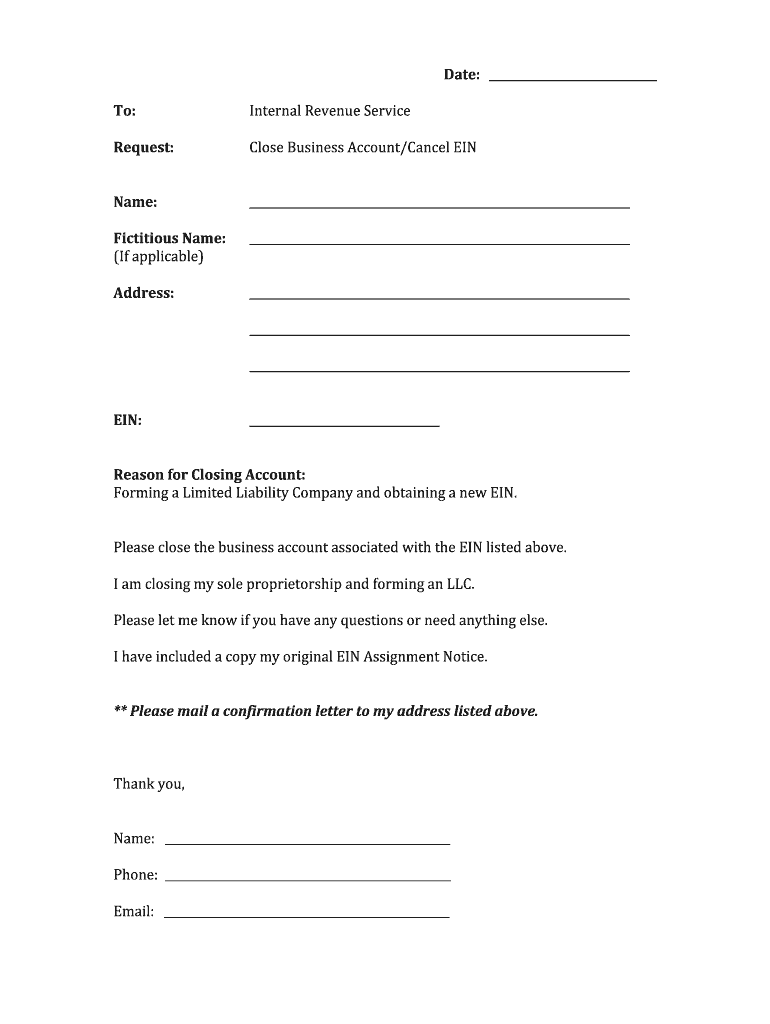

View 44 Sample Letter Format To Irs Laptrinhx News

What Is Penalty Abatement.

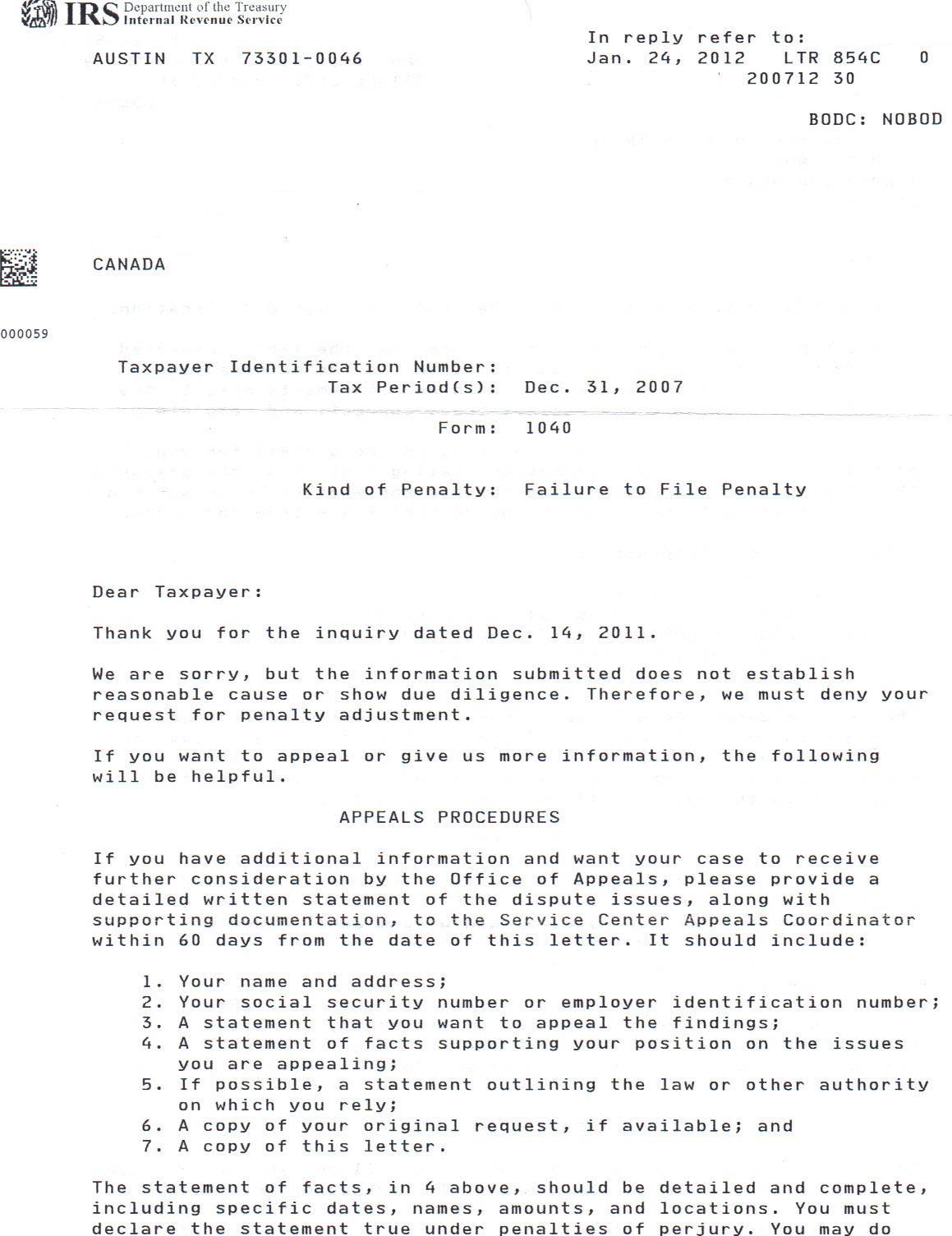

44+ forgiveness tax penalty waiver letter sample. You then write the letters RCnext to the amount you want waived on line 52. If the IRS has assessed penalties against you for failing to pay your federal taxes in full paying them late or failing to report your income you do have the option of requesting that the IRS abate or forgive these penalties. To Whom It May Concern I am writing to ask whether you would consider waiving the late payment charge associated with my most recent electricity bill dated February 13 2012 as the postal service lost the check and ordinarily it would have reached you at least 3 days before.

It should be sent by certified mail so the consumer has proof that it was received. This sample penalty abatement letter can be used by tax attorneys accountants or CPAs and individuals or businesses to provide a guide as to how to write a persuasive penalty abatement letter. -- If the bill was returned next question.

-- If so mandatory waiver of both Penalty. This letter also always contains detailed explanations about the unique situation that led to the non-compliance of the taxpayer alongside an explanation of reasons that qualifies the taxpayer for a waiver for the. In response to the unique aspects of the pandemic the AICPA has created a custom penalty abatement letter for members to use as a starting point for relief.

24 posts related to Irs Tax Penalty Abatement Letter. You need to specify what you should have taken as RMD and then you calculate the penalty tax due. If the IRS rejects your penalty waiver application a tax relief professional can persuade the IRS to amend their position.

People have criticized the software for giving many incorrect results over the years. There is no one-size-fits-all debt forgiveness letter. The template is available free to AICPA members.

The provided information does not constitute financial tax or legal advice. Updated 43 days ago Get Free Money Back. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

Penalty abatement is an administrative waiver that the IRS gives to people who miss a tax payment. Sample Penalty Abatement Letter to IRS to Waive Tax Penalties. In the instructions to form 5329 the IRS outlines the waiver process to avoid the 50 penalty tax.

Sample Letter To Irs To Waive Penalty. Complete Section IX of Form 5329. However if you want to improve your chances of your request being accepted you should work with a tax professional.

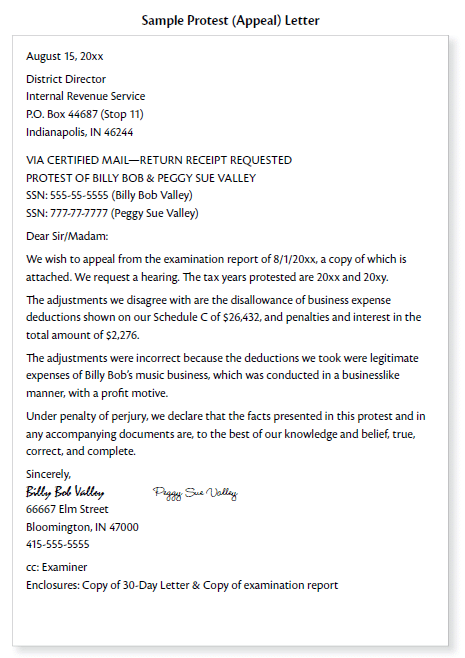

Irs Penalty Abatement Letter Partnership. Irs Penalty Abatement Request Letter Example. Here is a sample letter to request IRS penalty abatement.

Sample Letter Of Explanation For Missed-RMD Penalty Relief Alongside Form 5329 Download our Sample Letter Of Explanation For Missed-RMD Penalty Relief Alongside Form 5329 below and check out How To Correctly Fix A Forgotten Missed Or Miscalculated Required Minimum Distribution RMD for more tips and strategies. While you are still responsible for any delinquent. Letter of Waiver of Penalty Sample.

The consumer may send several such letters to different creditors and each letter needs to be unique. Just Ask For a First Time Penalty Abatement. Sample IRS Penalty Abatement Request Letter.

Letter To Irs To Waive Penalty Example. Sample Letter To Irs To Waive Late Penalty. Irs Penalty Abatement Letter Address.

Your Name Your Address. To Irs To Waive Rmd Penalty. This tends to be a first-time basis so people that dont pay for several years or tax periods may not have access to this resource.

Here are sample debt forgiveness letters. The irs will never waive the interest that is due on a past due tax debt but they will sometimes waive the penalties or a portion of the penalties if you can show reasonable cause as to request to waive penalty. You can use this template as a guide to help you write a letter.

First Time Penalty Abatement from IRS With Sample Letter 1 27 Dec 2016 in Tax Guide tagged forms IRS tax debt tax resolution by Robert Kayvon Esq. What You Need to Do. 24 posts related to Letter To Irs To Waive Penalty Example.

This penalty abatement request letter is usually written to the IRS to ask the IRS to forgive a tax penalty for a reasonable reason. If you feel that such is undeserved or if you feel that it would unfairly affect you then you can ask for. For instance you may be given a citation a penalty fee or a new financial obligation.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties. Irs Penalty Abatement Letter Sample. Did taxpayer communicate a new address to the Appraisal District before September 1st of the year the tax was assessed.

Free Sample Letter To Irs To Waive Penalty. You also are getting a waiver on the penalty itself rather than the taxes you owe. For example in may 2011 in westminster council area in london.

A waiver letter is a formal written request for the party receiving the letter to forego a certain restriction that would otherwise be put into effect such as a financial obligation contract or a citationHowever writing a letter of waiver isnt a 100 percent guarantee that the other party will comply. -- If not only possibility for waiver lies in provisions under 33011a1. By using this site you agree to the use of cookies.

Letter to waive penalty charge sample letter waive penalty fees. How Do You Write Ps In A Letter Elegant Ps Cover Letter 44 With Additional Doc Cover Letter. Was bill returned to tax office undelivered by USPS.

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News

View 44 Sample Letter Format To Irs Laptrinhx News